Epic Games Store vs Steam Market Share Statistics (2026)

wp:html

html

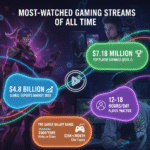

The digital game distribution landscape in 2026 continues to be dominated by two major platforms: Steam and Epic Games Store. While Steam maintains its position as the undisputed leader with a massive market share and extensive game library, Epic Games Store has carved out a significant niche through developer-friendly policies and strategic exclusive releases. This comprehensive analysis examines the latest statistics, market trends, and competitive dynamics shaping the PC gaming industry.

Market Overview: Global Gaming Revenue Distribution

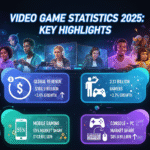

The global gaming market generated $187.7 billion in revenue during 2024, representing a 2.1% increase from the previous year. Mobile gaming continues to dominate with $92.6 billion (49% market share), followed by console gaming at $51.9 billion (28%), and PC gaming at $43.2 billion (23%). This distribution highlights the importance of cross-platform gaming strategies for reaching diverse audiences across different devices.

Steam Platform Performance Analysis

Steam continues to reign as the dominant force in PC digital distribution, achieving remarkable growth across all key metrics in 2024. The platform generated $10.8 billion in revenue, marking a substantial 24.14% increase from 2023’s $8.7 billion. This growth trajectory demonstrates Steam’s ability to maintain its market leadership while expanding its user base and engagement levels.

Steam User Engagement Metrics

Steam’s user engagement statistics reveal the platform’s strong community foundation. With 132 million monthly active users and 69 million daily active users, Steam maintains an impressive 52% daily-to-monthly user ratio, indicating high platform loyalty and regular engagement. The platform reached a peak of 39.31 million concurrent users in December 2024, setting new records for simultaneous online activity.

Steam Game Library and Content Growth

Steam’s extensive game catalog remains one of its strongest competitive advantages. The platform hosts over 100,000 titles, with 15,422 new games released in 2024 alone. This represents a significant increase from previous years, demonstrating the platform’s appeal to developers and its commitment to providing diverse gaming experiences for users.

Epic Games Store Market Position

Epic Games Store achieved significant milestones in 2024, generating $1.09 billion in total revenue, representing a 14.74% increase from 2023’s $950 million. However, the platform faces challenges in third-party game sales, which declined 18% year-over-year to $255 million, down from $310 million in 2023.

Epic Games Store User Growth

Despite revenue challenges in third-party sales, Epic Games Store demonstrated strong user growth. The platform reached 295 million PC users, an increase of 25 million from 2023. Cross-platform accounts totaled 898 million, reflecting the ecosystem’s broad reach across multiple gaming platforms and the growing importance of gaming content distribution across devices.

Epic Games Store Content Strategy

Epic Games Store released 1,100 new games in 2024, bringing the platform’s total library to over 4,000 products. While this represents substantial growth in content availability, it remains significantly smaller than Steam’s extensive catalog. The platform’s strategy continues to focus on developer-friendly revenue sharing and exclusive content deals to attract both developers and users.

Direct Platform Comparison

| Metric | Steam (2024) | Epic Games Store (2024) |

|---|---|---|

| Total Revenue | $10.8 billion | $1.09 billion |

| Monthly Active Users | 132 million | 67.2 million |

| Daily Active Users | 69 million | 31.5 million |

| Peak Concurrent Users | 39.31 million | 37.2 million (peak DAU) |

| Total Games Available | 100,000+ titles | 4,000+ products |

| New Games Released (2024) | 15,422 | 1,100 |

| Market Share (PC Distribution) | ~74% | ~10-11% |

| Developer Revenue Share | 70% (30% platform fee) | 88% (12% platform fee) |

Industry Trends and Future Outlook

Digital Distribution Platform Growth

The digital game distribution platform market is projected to grow from $1.09 billion in 2024 to $1.58 billion by 2033, representing a compound annual growth rate of 4.2%. This growth is driven by increasing internet penetration, cloud gaming adoption, and the continued shift from physical to digital game sales, with over 95% of game sales now occurring through digital channels.

Cross-Platform Gaming Integration

Cross-platform gaming has become a critical trend in 2026, with developers increasingly focusing on multi-platform releases to maximize audience reach. This strategy particularly benefits PC gaming platforms, as games can now reach users across console, mobile, and PC ecosystems. The integration of streaming platforms has also enhanced the visibility and social aspects of gaming, driving platform engagement.

Developer Revenue Models

The competition between platforms has led to more favorable terms for developers. Epic Games Store’s 88/12 revenue split continues to pressure other platforms to reconsider their commission structures. Additionally, Epic’s recent policy of taking 0% commission on the first $1 million in revenue per app represents a significant shift toward supporting independent developers and smaller studios.

Regional Market Dynamics

North America leads the digital game distribution market with a 45% share in 2024, driven by strong gaming communities and established platforms like Steam and Epic Games Store. Europe follows with a 30% market share, while Asia Pacific holds 20%. The remaining 5% is distributed across other regions, with emerging markets showing rapid growth potential.

Competitive Landscape Analysis

While Steam and Epic Games Store dominate the conversation, other platforms continue to serve niche markets. GOG focuses on DRM-free games, Ubisoft Connect provides access to over 100 PC titles through subscription models, and emerging cloud gaming services like Boosteroid serve 6.8 million users. This diversity in distribution channels reflects the industry’s evolution toward specialized platform offerings.

Frequently Asked Questions

Steam holds approximately 74% of the global PC gaming digital distribution market as of 2024. This dominant position is supported by its extensive game library of over 100,000 titles, large user base of 132 million monthly active users, and established ecosystem of community features and services.

Epic Games Store generated $1.09 billion in total revenue in 2024, representing a 14.74% increase from the previous year. However, third-party game sales specifically declined to $255 million, down 18% from 2023, indicating that much of the platform’s revenue comes from Epic’s own games like Fortnite and Rocket League.

Epic Games Store offers more favorable terms for developers with an 88/12 revenue split compared to Steam’s 70/30 split. Epic also provides additional incentives including 0% commission on the first $1 million in revenue per app and reduced Unreal Engine royalties for games published on their platform.

The PC gaming market generated $43.2 billion in revenue in 2024, representing 23% of the total global gaming market. This segment showed 4% growth year-over-year, outpacing both mobile (+3%) and console gaming (-1%) in terms of growth rate.

Steam hosts over 100,000 titles with 15,422 new games released in 2024, while Epic Games Store offers approximately 4,000 products with 1,100 new releases in 2024. Despite Epic’s growing catalog, Steam maintains a significant advantage in terms of game variety and selection.

Key trends include the growth of cross-platform gaming, cloud gaming services, subscription-based models, and improved developer revenue sharing. The market is projected to grow from $1.09 billion in 2024 to $1.58 billion by 2033, driven by increased internet accessibility and the continued shift from physical to digital sales.

Sources and References

- GamesMarkt – Epic Games Store Tops $1 Billion in 2024

- Udonis Gaming Industry – Gaming Industry Report 2026: Market Size & Trends

- Business Research Insights – Digital Game Distribution Platform Market Size & Share

- SQ Magazine – Steam Statistics 2026: Users, Revenue, Top Games & Market Trends

/wp:html