Global Esports Revenue Statistics For 2026

wp:html

html

The global esports industry continues its remarkable expansion, with 2026 projected to be a landmark year for competitive gaming revenue. Multiple research organizations have converged on strong growth projections, indicating that the esports ecosystem is maturing into a billion-dollar entertainment sector that rivals traditional sports in both viewership and economic impact.

Core Esports Revenue Projections for 2026

Esports Market Revenue by Source

| Research Source | 2024 Revenue (USD) | 2026 Projection (USD) | Market Scope | CAGR |

|---|---|---|---|---|

| Grand View Research | $2.13 billion | $2.64 billion | Core esports market | 23.1% |

| SQ Magazine | $1.54 billion | $1.79 billion | Core revenue streams | 16.2% |

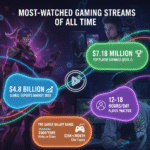

| Statista Market Forecast | $4.3 billion | $4.8 billion | Total market including betting | 11.6% |

| Stellar Market Research | $4.14 billion | $4.51 billion | Global esports market | 9.04% |

Esports Betting: The Fastest Growing Revenue Segment

The esports betting market represents the most dynamic growth segment within the broader esports ecosystem. Current projections indicate that esports betting will generate approximately $2.8 billion in revenue by 2026, representing a significant portion of the total market value. This growth trajectory reflects the increasing mainstream acceptance of competitive gaming and the integration of traditional sports betting frameworks into esports events.

Esports Betting Market Growth

The betting segment’s rapid expansion is driven by several factors including improved regulatory frameworks, enhanced streaming technology that enables real-time wagering, and the growing sophistication of esports analytics. Popular titles like Counter-Strike 2, League of Legends, and Dota 2 have established robust competitive circuits that provide consistent betting opportunities throughout the year.

Global Esports Audience Growth and Demographic Trends

The esports audience is projected to reach 640.8 million viewers globally by 2026, representing a significant milestone in the industry’s evolution toward mainstream entertainment. This audience comprises 318.1 million dedicated fans and 322.7 million occasional viewers, indicating both a strong core fanbase and growing peripheral interest in competitive gaming.

Regional Distribution of Esports Viewership

The Asia-Pacific region dominates global esports viewership, accounting for over 57% of the total audience. China and the Philippines combined represent approximately 40% of the worldwide esports fanbase, highlighting these markets as critical drivers of industry growth. The demographic profile skews young, with 43% of fans aged between 18-34 years, making esports particularly attractive to advertisers seeking to reach digital-native consumers.

Revenue Stream Analysis and Market Composition

The esports revenue ecosystem consists of multiple interconnected streams that collectively drive industry growth. Sponsorship and advertising continue to represent the largest revenue components, while emerging segments like media rights and streaming platforms are experiencing rapid expansion.

2026 Esports Revenue Breakdown by Stream

| Revenue Stream | 2026 Projection (USD) | Market Share | Growth Rate |

|---|---|---|---|

| Sponsorship & Advertising | $1.21 billion | 41% | 18% |

| Media Rights | $491 million | 17% | 25% |

| Merchandise & Ticketing | $312 million | 11% | 15% |

| Publisher Fees | $285 million | 10% | 12% |

| Streaming Revenue | $618 million | 21% | 22% |

Media rights represent the fastest-growing segment with a projected compound annual growth rate of over 25%, driven by increased demand for exclusive broadcasting deals and strategic partnerships with streaming platforms. The rise of cross-platform gaming has also expanded the potential audience reach, making esports content more valuable to traditional media companies and technology platforms alike.

Market Challenges and Regulatory Considerations

Despite robust growth projections, the esports industry faces several challenges that could impact revenue realization in 2026. Regulatory uncertainty around esports betting in key markets creates potential headwinds, while concerns about match-fixing and competitive integrity require ongoing industry attention. Additionally, the concentration of viewership in specific geographic regions creates both opportunities and risks for revenue diversification.

The industry’s rapid professionalization has also introduced new costs related to player salaries, facility investments, and production quality improvements. While these investments enhance the overall viewing experience and legitimacy of esports as entertainment, they also impact profit margins for organizations and event organizers.

Technology Innovation and Future Revenue Opportunities

Emerging technologies including virtual reality, augmented reality, and artificial intelligence are creating new revenue opportunities within the esports ecosystem. VR esports competitions offer immersive viewing experiences that command premium pricing, while AI-driven analytics provide enhanced betting markets and fantasy sports opportunities.

The integration of blockchain technology and non-fungible tokens (NFTs) has introduced novel monetization strategies, though adoption remains limited compared to traditional revenue streams. 5G network deployment is expected to enhance mobile esports experiences, particularly important given the significant mobile gaming audience in key markets like China and Southeast Asia.

Long-term Market Outlook Beyond 2026

Industry forecasts suggest sustained growth through the remainder of the decade, with total market value projected to reach $7.46 billion by 2030 according to Grand View Research. This represents a compound annual growth rate of approximately 23% from 2026 to 2030, indicating that the current growth trajectory is expected to continue despite market maturation.

The expansion of collegiate esports programs, integration with traditional sports organizations, and growing government support in key regions provide structural foundations for continued growth. However, market analysts note that growth rates may moderate as the industry matures and faces increased competition from other digital entertainment sectors.

Frequently Asked Questions

Global esports revenue projections for 2026 vary by source and market scope. Core esports revenue is projected between $1.79 billion and $2.64 billion, while the total market including betting and peripheral streams could reach $4.8 billion. The variance depends on whether research includes betting revenue, merchandise, and other adjacent markets.

The esports betting market is projected to reach $2.8 billion in revenue by 2026, representing the fastest-growing segment within the broader esports ecosystem. This growth is driven by improved regulatory frameworks, enhanced streaming technology, and the increasing sophistication of esports analytics platforms.

Global esports viewership is projected to reach 640.8 million by 2026, comprising 318.1 million dedicated fans and 322.7 million occasional viewers. The Asia-Pacific region accounts for over 57% of this audience, with China and the Philippines representing approximately 40% of the global fanbase.

North America generates the highest esports revenue per capita, contributing over $600 million in 2026 despite having a smaller audience than Asia-Pacific. The Asia-Pacific region dominates in viewership volume with 57% of global audience, while Europe contributes approximately $245 million to the global esports economy.

The primary esports revenue streams include sponsorship and advertising (41% of market), streaming revenue (21%), media rights (17%), merchandise and ticketing (11%), and publisher fees (10%). Media rights represent the fastest-growing segment with over 25% annual growth rate, driven by exclusive broadcasting deals and streaming platform partnerships.

Esports revenue growth significantly outpaces traditional sports, with compound annual growth rates between 16-23% compared to single-digit growth in most traditional sports markets. However, the absolute revenue scale remains much smaller, with total esports revenue representing a fraction of major traditional sports leagues’ annual revenues.

Sources and Citations

- Grand View Research. (2026). “Esports Market Size, Share & Trends Analysis Report 2026-2030”

- Statista Market Forecast. (2026). “Esports Market Forecast Worldwide”

- SQ Magazine. (2026). “Esports Statistics 2026: Market Growth, Viewership, and Trends”

- DemandSage. (2026). “eSports Viewership Statistics 2026 – Demographics & Growth”

- Future Market Insights. (2026). “eSports Market Trends & Innovations 2026–2035”

/wp:html

wp:paragraph

/wp:paragraph