Mobile Game Statistics (2026)

wp:html

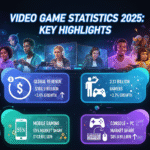

Mobile gaming generated $92 billion in revenue during 2024, marking a 4% increase from the previous year. The sector reached 3.5 trillion hours of total playtime, with sessions jumping 12% year-over-year. Despite a 7% decline in new downloads to 49 billion installs, engagement metrics showed record growth. The industry now accounts for approximately 49% of the global gaming market, with projections reaching $103 billion in 2026.

Mobile Game Statistics Key Findings

- Mobile gaming reached $92 billion in revenue during 2024, representing a 4% year-over-year increase and 49% of the global gaming market.

- Total time spent in mobile games hit 3.5 trillion hours in 2024, marking an 8% increase from 2023.

- Gaming sessions rose 12% year-over-year in 2024, indicating stronger player retention despite fewer new downloads.

- Mobile game downloads declined 7% to 49 billion installs in 2024, the lowest level since 2019.

- In-app purchase revenue from mobile games reached $82 billion in 2024, up 4% from the previous year.

Mobile Game Statistics Revenue Growth

The mobile gaming sector showed steady revenue expansion in 2024. Global in-app purchase revenue reached $82 billion, marking a 4% increase from 2023. This growth occurred alongside broader app monetization trends, with total mobile app IAP revenue hitting $150 billion.

North America led regional revenue gains with $24 billion in mobile game spending, representing an 8% year-over-year increase. The United States remained the top market globally for consumer spend. China’s iOS market maintained second place, while Japan ranked third despite experiencing a 6% revenue decline.

Hybrid monetization strategies gained traction in 2024. Games combining in-app purchases with advertising revenue recorded 37% growth in IAP revenue year-over-year. This approach allowed developers to maximize revenue while maintaining free-to-play accessibility.

Mobile Game Statistics Player Engagement

Engagement metrics reached new highs in 2024. Players spent 3.5 trillion hours in mobile games, an 8% increase from 2023. Total gaming sessions climbed 12% year-over-year, demonstrating stronger retention patterns across the industry.

These gains occurred despite declining download numbers. New mobile game installs fell 7% to 49 billion in 2024, continuing a trend that began in 2022. The divergence between downloads and engagement reflects a maturing gaming market focused on retaining existing players rather than acquiring new users.

Live operations models proved critical for sustaining engagement. Games using live ops strategies captured 84% of total mobile game IAP revenue in 2024. Regular content updates, seasonal events, and limited-time offers kept players active and spending.

Regional Mobile Game Statistics

Regional performance varied significantly in 2024. Emerging markets showed stronger growth patterns compared to mature markets. Latin America recorded 13% revenue growth alongside an 8% decline in downloads, indicating improved monetization.

The Middle East posted 18% revenue growth in 2024, making it one of the fastest-growing regions. North America saw 9% revenue expansion, while Asia’s major markets declined 3%. This shift reflects changing dynamics as Western and emerging markets gain relative strength.

| Region | Revenue Growth 2024 | Download Trend |

|---|---|---|

| Latin America | +13% | -8% |

| Middle East | +18% | Positive |

| North America | +9% | Stable |

| Asia (Major Markets) | -3% | -6% |

India maintained its position as the world’s largest market by downloads. The country recorded 8.45 billion mobile game installs during fiscal year 2024-25. However, India’s IAP revenue remained modest at $400 million, highlighting significant monetization opportunities.

Mobile Game Statistics by Genre

Genre performance revealed clear revenue leaders. RPG games and strategy titles dominated monetization despite representing smaller download shares. Strategy games generated 21.4% of total mobile gaming revenue while accounting for only 4% of downloads.

Hybrid-casual games emerged as a growth category. This mid-tier complexity genre saw 37% IAP revenue growth in 2024. The segment bridges traditional casual and mid-core gaming, offering deeper progression systems than hyper-casual titles while maintaining accessibility.

Puzzle games continued dominating download charts. Simulation titles led by total installs, while RPG and strategy games captured the highest revenue per download. This pattern underscores different monetization approaches across gaming communities.

Top Mobile Game Statistics 2024

Four new titles joined the billion-dollar revenue club in 2024. Last War: Survival, Whiteout Survival, Dungeon & Fighter, and Brawl Stars each surpassed $1 billion in annual revenue. The mobile gaming industry now includes 11 games generating over $1 billion yearly.

Last War: Survival achieved exceptional growth, generating $895 million in the first half of 2026, representing a 104% increase from the same period in 2024. Whiteout Survival posted even stronger gains at 126% growth, jumping from $369 million to $834 million.

| Game Title | H1 2026 Revenue | Growth Rate |

|---|---|---|

| Last War: Survival | $895 million | +104% |

| Whiteout Survival | $834 million | +126% |

| Pokémon TCG Pocket | $390 million | New Release |

Pokémon TCG Pocket achieved rapid success following its late 2024 launch. The collectible card game surpassed $390 million in gross revenue within its first months. Strategic updates and limited-time events drove sustained spending among collectors.

Mobile Game Statistics Market Projections

Industry forecasts project mobile gaming revenue reaching $103 billion in 2026, representing approximately 55% of the global gaming market. This estimate reflects a 2.9% year-over-year increase from 2024’s $92 billion. The broader global games market is projected at $188.8 billion for 2026.

Longer-term projections vary by source. Conservative estimates place 2027 mobile gaming revenue at $119 billion, while more optimistic forecasts suggest $156 billion by 2029. The variation reflects different methodologies for calculating revenue streams and regional coverage.

Growth drivers include expanding smartphone penetration in emerging markets, improving 5G infrastructure, and evolving monetization strategies. Cloud gaming services are beginning to contribute meaningfully, though they remain a small fraction of total revenue. The shift toward cross-platform gaming also supports mobile growth as publishers extend popular franchises to mobile devices.

FAQ

How much revenue does mobile gaming generate in 2026?

Mobile gaming is projected to generate approximately $103 billion in revenue during 2026, representing about 55% of the total global gaming market. This reflects a 2.9% increase from 2024’s $92 billion in mobile gaming revenue.

Are mobile game downloads increasing or decreasing?

Mobile game downloads declined 7% in 2024 to 49 billion installs, the lowest level since 2019. However, engagement metrics increased significantly, with time spent rising 8% and sessions jumping 12% year-over-year.

Which region shows the strongest mobile game growth?

The Middle East recorded the strongest regional growth at 18% revenue increase in 2024, followed by Latin America at 13%. These emerging markets outperformed mature regions like Asia’s major markets, which declined 3%.

What percentage of gaming revenue comes from mobile?

Mobile gaming accounts for approximately 49-55% of global gaming revenue. In 2024, mobile generated $92 billion of the total $187.7 billion gaming market, representing 49%. This share is projected to increase to 55% in 2026.

Which mobile game genres generate the most revenue?

RPG and strategy games lead mobile gaming revenue generation. Strategy games produced 21.4% of total revenue despite accounting for only 4% of downloads. Hybrid-casual games showed the fastest growth at 37% year-over-year in IAP revenue.

Sources

Sensor Tower State of Mobile Gaming 2026

Udonis Mobile Gaming Statistics 2026

/wp:html