Board Game Sales Statistics 2026

wp:html

html

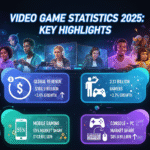

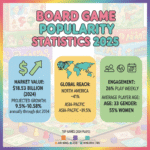

The board game industry continues to experience remarkable growth as we move through 2026, driven by a combination of innovative gameplay mechanics, thriving crowdfunding platforms, and expanding gaming communities worldwide. The global board game market stands at a valuation between $12.8 billion and $15.83 billion in 2026, depending on market analysis methodology and segment definitions used by different research firms.

Multiple industry reports present varying figures for board game sales statistics 2026, with Fortune Business Insights reporting the market at $15.83 billion while Global Market Insights estimates $12.8 billion. This variance stems from different approaches to categorizing game types and regional coverage. Regardless of the exact figure, all major research firms agree on the industry’s strong upward trajectory with compound annual growth rates ranging from 5.5% to 10.58% through the forecast period.

The market’s expansion is fueled by several key factors, including the democratization of game publishing through crowdfunding platforms like Kickstarter and Gamefound, which have empowered independent creators to bypass traditional publishing barriers and connect directly with enthusiastic backer communities.

| Year | Market Size (USD Billion) | YoY Growth Rate |

|---|---|---|

| 2024 | 14.37 | — |

| 2026 | 15.83 | 10.2% |

| 2032 (Projected) | 32.00 | CAGR: 10.58% |

Board Game Sales by Type in 2026

The diversity of board game types available in 2026 reflects the maturity and sophistication of the market. Strategy and war games dominate consumer preferences, accounting for approximately 24% of the global market share. These games appeal to players seeking intellectual challenges and complex decision-making scenarios that unfold over extended play sessions.

Tabletop strategy games continue to lead the category with titles like Settlers of Catan, Gloomhaven, and Wingspan maintaining strong sales performance. The enduring popularity of these games demonstrates that players value replayability, depth of gameplay, and the social interaction that comes with gathering around a table.

Collectible card games represent another significant segment, with properties like Magic: The Gathering and Pokémon maintaining dedicated player bases. The transition of many physical card games to digital platforms has not diminished physical sales, as mobile gaming trends have actually introduced new audiences to these traditional formats.

Role-Playing Games Market Growth

Role-playing games have experienced remarkable growth, particularly among younger demographics. Dungeons & Dragons continues to dominate this segment, benefiting from mainstream media exposure and celebrity endorsements. The RPG category now represents a substantial portion of board game market revenue, with new publishers entering the space regularly.

The success of RPGs reflects broader entertainment trends where players seek immersive storytelling experiences that allow for character development and collaborative narrative creation. This trend aligns with how cross-platform party games are changing social entertainment patterns across digital and physical spaces.

Board Game Distribution Channels in 2026

The landscape of how consumers purchase board games has evolved significantly, with online retail now commanding approximately 42% of market share. E-commerce platforms ranging from Amazon to publisher-direct sales have made acquiring board games more convenient than ever, allowing consumers to access niche titles that might not be available in their local markets.

Specialty hobby stores maintain a crucial 28% share of distribution, serving as community hubs where players can discover new games through demos, participate in organized play events, and receive expert recommendations from knowledgeable staff. These stores create value beyond simple transactions by fostering local gaming communities.

Rise of Direct-to-Consumer Sales

Publisher-direct sales have grown substantially, with approximately 45% of board game publishers now utilizing direct-to-consumer online sales channels. This shift allows publishers to maintain higher margins while building direct relationships with their customer base, enabling better market research and community engagement.

The growth of board game cafes and pop-up gaming venues contributes to the “Others” category, accounting for about 10% of distribution. These establishments provide low-commitment entry points for curious consumers who want to try games before purchasing.

Regional Board Game Market Analysis

North America maintains its position as the largest regional market for board games, representing approximately 41.68% of global sales in 2024 and continuing this dominance through 2026. The United States specifically accounts for roughly 60.5% of North American board game revenue, driven by strong consumer culture around social activities and disposable income available for entertainment purchases.

Europe demonstrates steady growth with Germany, France, and the United Kingdom leading the charge. Germany in particular holds cultural significance as the birthplace of modern Eurogames, with the annual Essen Spiel convention continuing to influence global industry trends and serve as a launching platform for major releases.

Asia-Pacific Emerging Market Dynamics

The Asia-Pacific region represents the fastest-growing segment for board game sales statistics, with a projected compound annual growth rate of 6% through 2034. Rising middle-class populations in countries like China, India, and Southeast Asian nations are discovering tabletop gaming through gaming cafes and educational institutions.

Japan’s board game market leans toward minimalistic game designs and storytelling-focused experiences, while China is emerging as both a manufacturing powerhouse and a substantial consumer market. The country’s ability to combine digital and analog gaming formats presents unique opportunities for hybrid entertainment experiences.

Top Board Game Brands and Publishers

The competitive landscape of board game publishing in 2026 features a mix of legacy publishers and innovative newcomers. Hasbro continues to lead with estimated revenues around $1.4 billion from board game properties, leveraging classic titles like Monopoly, Risk, and Clue that maintain multigenerational appeal.

Asmodee Group has established itself as the dominant force in hobby gaming, with estimated revenues exceeding $1.15 billion through strategic acquisitions and portfolio management. The company’s ownership of evergreen franchises like Catan, Ticket to Ride, and Dixit provides stable revenue streams while supporting innovative new releases.

| Brand | Estimated 2026 Revenue (USD Million) | Key Titles |

|---|---|---|

| Hasbro | 1,420 | Monopoly, Risk, Clue |

| Asmodee Group | 1,150 | Catan, Ticket to Ride, Dixit |

| Ravensburger | 980 | Disney Villainous, Labyrinth |

| Cephalofair Games | 410 | Gloomhaven, Frosthaven |

| Stonemaier Games | 320 | Wingspan, Scythe |

Independent Publisher Success Stories

Cephalofair Games exemplifies how independent publishers can achieve remarkable success through quality design and community engagement. Frosthaven raised close to $13 million on Kickstarter, becoming the most funded tabletop project in the platform’s history. Similarly, Stonemaier Games has built a reputation for premium components and elegant game design.

Board Game Crowdfunding Statistics 2026

Crowdfunding platforms have fundamentally transformed how board games reach market, providing alternative funding paths that bypass traditional publisher gatekeepers. Kickstarter’s tabletop category generated approximately $220 million in 2024, though this represents a decline from the $270 million peak reached in 2021 during pandemic-driven demand.

Gamefound has emerged as a serious competitor in the crowdfunding space, with tabletop projects raising $85 million in 2024, representing 49% year-over-year growth. When including late pledges and pledge manager operations, Gamefound’s total reached approximately $156 million, narrowing the gap with industry leader Kickstarter.

Notable 2024 Crowdfunding Campaigns

The Cosmere RPG from Brotherwise Games achieved the highest funded tabletop project of 2024 at $15.1 million, demonstrating strong demand for licensed properties with established fanbases. Other successful campaigns included the Cyberpunk 2077 board game at $7.6 million and Lands of Evershade at $7.4 million.

The success rate for Kickstarter projects stands at approximately 41.71% as of late 2024, with tabletop games historically performing better than platform averages. Projects that reach 20% of their funding goal have a 79% chance of ultimate success, highlighting the importance of strong campaign launches.

Board Game Demographics and Consumer Insights

Understanding who purchases and plays board games provides crucial context for market dynamics. The 13-40 age range represents the dominant consumer segment, accounting for approximately 60% of board game sales. This broad demographic encompasses millennials and Generation Z players who value face-to-face social interaction as a counterbalance to digital-heavy lifestyles.

Survey data indicates that approximately 38% of Generation Z finds board games enjoyable, with notable preference for cooperative formats over competitive designs. This demographic shift influences game design trends, as publishers increasingly develop titles emphasizing collaboration and shared goals rather than zero-sum competition.

Gender Diversity in Gaming

Female participation in board game design and development has increased by 35% since 2019, reflecting growing gender diversity across the industry. This shift manifests in both creator demographics and game themes, with more titles featuring gender-neutral mechanics and inclusive storytelling.

Adults aged 25-34 primarily engage with board games to connect with friends, while those aged 34-54 play to relax and unwind. The educational benefits of board games include improving strategic thinking for 89% of players and enhancing social skills for 76% according to education industry surveys.

Market Challenges and Industry Headwinds

The board game industry faces several significant challenges in 2026 that impact publisher margins and consumer pricing. Production costs have increased by 12-15% year-over-year due to inflation pressures and rising raw material prices. These cost increases disproportionately affect independent publishers who lack the economies of scale enjoyed by larger competitors.

Shipping and logistics continue to present medium-impact challenges, with post-pandemic supply chain disruptions still affecting release schedules and profit margins. Publishers often face difficult choices between absorbing increased costs or passing them to consumers through higher retail prices.

Digital Gaming Competition

Competition from digital entertainment platforms represents an ongoing challenge, though board games maintain strong engagement through their tactile and social appeal. The threat level from digital alternatives is considered medium rather than high, as board games serve different entertainment needs than video games or mobile apps.

Market saturation concerns remain relatively low due to continued innovation in game mechanics, themes, and player experiences. The industry’s ability to serve niche interests and provide novel gameplay experiences helps offset saturation risks that might affect more commoditized entertainment categories.

Technology Integration and Innovation Trends

Augmented reality integration in board games is expected to grow at a CAGR of 18% through 2026, representing one of the most exciting technological developments in the industry. Publishers are experimenting with companion apps that enhance traditional gameplay through digital overlays, soundscapes, and dynamic storytelling elements.

The use of eco-friendly manufacturing processes has increased by 22% from 2020 to 2023, driven by consumer demand for sustainable products. Publishers are exploring recyclable materials, reduced plastic components, and carbon-neutral shipping options to appeal to environmentally conscious consumers.

The integration of digital features like mobile apps and online components creates hybrid experiences that bridge physical and digital play. This trend acknowledges how online communities are shaping entertainment preferences across all age groups.

Board Game Market Forecast Through 2034

The board game industry is projected to maintain robust growth through the next decade, with market size estimates ranging from $20.6 billion to $41.63 billion by 2032-2034 depending on research methodology. These projections reflect continued consumer interest in tabletop entertainment and the industry’s ability to innovate and adapt to changing preferences.

The conservative estimate from Global Market Insights projects the market reaching $20.6 billion by 2034 with a steady 5.5% CAGR, while more optimistic forecasts from firms like Fortune Business Insights and IMARC Group project figures above $30 billion with CAGRs exceeding 9%.

Emerging Market Opportunities

Latin America and Middle East & Africa represent emerging opportunities with lower current market shares of 7.1% and 5.0% respectively, but significant growth potential as disposable incomes rise and gaming culture spreads through these regions.

The educational board games segment is projected to reach $2.8 billion by 2026, reflecting growing demand for learning tools that make education engaging. This segment represents approximately 12% of the overall industry with projections for steady growth as schools and parents seek alternatives to screen-based learning.

Industry Events and Community Building

Major industry conventions like Essen Spiel in Germany, Gen Con in the United States, and UK Games Expo continue to serve as crucial touchpoints where publishers unveil new releases, retailers make purchasing decisions, and communities gather to celebrate their shared hobby.

Board game cafes have proliferated globally, providing accessible entry points for curious consumers and regular gathering spaces for established enthusiasts. These venues often stock hundreds of titles available for hourly rental, allowing customers to experience games before committing to purchases.

The community aspect of board gaming draws parallels to how gaming communities function in digital spaces, with both physical and virtual gathering spots serving important social roles for participants.

Pricing Trends and Consumer Spending

The average retail price for new board games ranges from $20 to $50 depending on complexity, component quality, and publisher positioning. However, premium and collector editions can exceed $100, indicating a significant market segment willing to pay for enhanced production values and exclusive content.

Kickstarter campaign funding goals for independent projects typically fall in the $10,000-$50,000 range, reflecting realistic production cost estimates for small-scale releases. Successful campaigns often exceed their goals by significant margins when tapping into enthusiastic niche communities.

Content Creation and Media Influence

Social media influencers and YouTube content creators play increasingly important roles in driving board game discovery and sales. Channels dedicated to reviews, playthroughs, and strategy discussions introduce games to potential buyers while building anticipation for upcoming releases.

The livestreaming of board game sessions has created new forms of entertainment content, with some shows attracting thousands of viewers. This mirrors broader trends in how gaming content is consumed and discussed across digital platforms.

Retail Environment Evolution

Traditional brick-and-mortar retail continues to play a significant role, with hypermarkets and supermarkets accounting for approximately 19% of board game distribution. These mass-market channels provide impulse purchase opportunities and introduce mainstream consumers to popular titles.

Specialty stores differentiate themselves through expertise, community events, and curated selections that emphasize hobby gaming over mass-market titles. These retailers often host organized play events, tournaments, and game nights that build customer loyalty beyond simple transactions.

Manufacturing and Supply Chain Considerations

China remains the dominant manufacturing hub for board games, though publishers are exploring diversification to mitigate supply chain risks. Production lead times typically range from 60-90 days for standard print runs, with additional time required for ocean freight and distribution.

Component quality has become a key differentiator, with players willing to pay premium prices for games featuring custom dice, miniatures, upgraded cardstock, and other enhanced production values. This trend toward premiumization reflects mature consumer preferences and willingness to invest in games expected to provide years of entertainment.

Licensing and Intellectual Property

Licensed board games based on popular movies, TV shows, and video game franchises represent a substantial market segment. Properties like Star Wars, Marvel, and Lord of the Rings command premium shelf space and consumer attention, though original intellectual properties continue to succeed when supported by strong design and marketing.

The relationship between tabletop and digital games has evolved beyond simple competition, with successful properties now spanning both mediums. Popular board games receive digital adaptations while video game franchises increasingly spawn tabletop versions, creating integrated entertainment ecosystems.

Educational and Therapeutic Applications

Board games are increasingly recognized for cognitive benefits including improved strategic thinking, enhanced social skills, and stress reduction. Educational institutions incorporate gaming into curricula to teach subjects ranging from mathematics to history through engaging interactive experiences.

Therapeutic applications of board games include treatments for social anxiety, cognitive rehabilitation, and family counseling. The structured social interaction provided by games creates safe frameworks for developing interpersonal skills and communication abilities.

Solo Gaming Trend

Solo board gaming has emerged as a significant trend, with publishers designing games specifically for single-player experiences or including solo modes in multiplayer titles. This development responds to changing household structures and consumer desires for engaging entertainment that doesn’t require coordinating schedules with other players.

The solo gaming community has organized online through forums and social media groups where players share strategies, variants, and custom scenarios. This demonstrates how board gaming culture adapts to incorporate both solitary enjoyment and community participation.

FAQs

What is the current size of the board game market in 2026?

The global board game market is valued between $12.8 billion and $15.83 billion in 2026, with different research firms providing varying estimates based on their methodologies and segment definitions. Fortune Business Insights reports the market at $15.83 billion with a projected CAGR of 10.58% through 2032, while Global Market Insights estimates $12.8 billion with a 5.5% CAGR through 2034.

Which region dominates board game sales?

North America dominates the board game market with approximately 41.68% of global sales in 2024, continuing through 2026. The United States specifically accounts for about 60.5% of North American revenue. Europe follows with approximately 29% market share, while Asia-Pacific represents the fastest-growing region at 22.8% share with a 6% projected CAGR.

How much money do board games raise through crowdfunding?

Kickstarter’s tabletop category generated approximately $220 million in 2024, while Gamefound raised $85 million in project funding plus additional revenue through late pledges and pledge manager operations, totaling about $156 million. Combined, these platforms raised over $300 million for board game projects in 2024, though this represents a decline from the 2021 peak of $270 million on Kickstarter alone.

What are the most popular types of board games?

Strategy and war games lead the market with approximately 24% share, followed by tabletop strategy games at 28.4% when including related categories. Collectible card games account for about 18.7% of the market, while role-playing games represent 13.6%. Monopoly remains the dominant individual title, generating approximately $3 billion in revenue during 2024.

Who are the top board game companies?

Hasbro leads with estimated 2026 revenues of $1.42 billion from board game properties including Monopoly, Risk, and Clue. Asmodee Group follows with approximately $1.15 billion, controlling franchises like Catan, Ticket to Ride, and Dixit. Ravensburger generates around $980 million, while successful independent publishers like Cephalofair Games and Stonemaier Games earn $410 million and $320 million respectively through crowdfunding-backed premium titles.

What age groups buy the most board games?

The 13-40 age range represents approximately 60% of board game consumers, with the 25-34 segment being particularly active. Young adults aged 18-34 comprise about 47% of regular board game enthusiasts. Generation Z shows growing interest with 38% finding board games enjoyable, particularly cooperative formats. Children aged 5-12 account for 22.5% of the market, while adults over 41 represent 17.1%.

How is online retail affecting board game sales?

Online retail now commands approximately 42% of board game distribution, making it the largest sales channel. E-commerce platforms from Amazon to publisher-direct sales provide convenient access to both mainstream and niche titles. About 45% of board game publishers now utilize direct-to-consumer online sales. Despite digital growth, specialty stores maintain 28.6% market share through community building and expert service.

What is the board game market forecast for 2032?

Market projections for 2032 range from $20.6 billion to $32 billion depending on research methodology. Fortune Business Insights projects $32 billion with a 10.58% CAGR, while Global Market Insights estimates $20.6 billion with a 5.5% CAGR through 2034. All major research firms agree on continued strong growth driven by crowdfunding, online retail, and demographic trends favoring social gaming experiences.

Sources

- Fortune Business Insights. “Board Games Market Size, Share & Trends Analysis [2032].” https://www.fortunebusinessinsights.com/board-games-market-104972

- Global Market Insights. “Board Games Market Size & Share, Forecasts Report 2026-2034.” https://www.gminsights.com/industry-analysis/board-games-market

- Technavio. “Board Games Market to Grow by USD 5.17 Billion from 2026-2029.” https://www.prnewswire.com/news-releases/board-games-market-to-grow-by-usd-5-17-billion-from-2025-2029

- BoardGameWire. “Gamefound closes gap on Kickstarter as crowdfunding giant’s 2024 dollars raised remains flat.” https://boardgamewire.com/index.php/2025/02/06/gamefound-kickstarter-2024-crowdfunding

/wp:html