Board Game Statistics 2026

wp:html

html

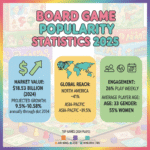

The board game industry has evolved into a multi-billion-dollar global phenomenon, combining traditional gameplay with modern innovation. According to recent market research, the global board game market reached $18.53 billion in 2024 and continues to experience robust growth across all major regions.

Global Board Game Market Size and Revenue Growth

The global board game market demonstrates impressive expansion, with multiple forecasting models projecting sustained growth through the next decade. The market valuation stood at $18.53 billion in 2024, establishing a strong foundation for future development.

Different research methodologies produce varying estimates based on how market segments are defined. Some forecasts focus exclusively on traditional board games, while others incorporate broader tabletop gaming categories or combine board games with playing cards. This segmentation variance explains the range of projections, though all trajectories point toward consistent upward momentum.

Projections indicate the market will reach between $15.83 billion and $22.03 billion by 2026, depending on the specific segment definitions applied. The broader playing cards and board games sector forecasts growth from $20.31 billion in 2024 to $22.03 billion in 2026, representing an approximate 8.4 percent compound annual growth rate.

Looking further ahead, long-term projections anticipate the global board games market expanding to $41.63 billion by 2033, implying a compound annual growth rate of 9.32 percent between 2026 and 2033. Alternative forecasts for the combined playing cards and board games segment project $31.93 billion by 2030 with an 8.3 percent CAGR.

Market Growth Projections for 2026 Through 2029

The board game industry is expected to add $5.17 billion in value from 2026 to 2029, growing at a 9.5 percent compound annual growth rate during this period. Within this broader category, the tabletop games segment shows even stronger momentum, with an anticipated increase of $4.76 billion over the same timeframe at a steeper 12.3 percent CAGR.

This acceleration in the tabletop segment suggests that social gaming experiences and community-focused play patterns are becoming increasingly influential drivers of market expansion. The relative proximity of these increments indicates that tabletop gaming represents a substantial portion of overall board game market activity.

Regional Board Game Market Statistics and Distribution

Geographic distribution patterns reveal distinct characteristics across major markets, with North America maintaining dominance while Asia-Pacific emerges as the fastest-growing region globally.

North American Board Game Market Performance

North America commanded approximately 41.7 percent of the global board games market share in 2024, establishing itself as the largest regional market. Within this region, the United States board game market specifically generated $4.58 billion in revenue during 2024.

The U.S. market trajectory appears particularly robust, with forecasts projecting nearly threefold expansion from $4.58 billion in 2024 to $11.73 billion by 2033. This anticipated growth represents a compound annual growth rate of 9.87 percent, slightly exceeding the global average and reinforcing North America’s position as a trendsetting market for design innovation, distribution strategies, and licensing arrangements.

Asia-Pacific Board Game Market Growth Trends

While North America retains the largest current market share, Asia-Pacific is positioned for the most rapid expansion over the coming decade. Regional forecasts indicate Asia-Pacific will experience a compound annual growth rate of approximately 6 percent through 2034 in some projections.

This accelerated growth reflects several converging factors including rising disposable incomes, expanding middle-class populations, increasing urbanization rates, and growing interest in Western-style entertainment products. The region’s demographic advantages and improving distribution infrastructure suggest sustained momentum for board game adoption.

Similar to how cross-platform gaming experiences have expanded globally, board games are finding new audiences across diverse cultural contexts in Asian markets.

European Board Game Market Outlook

Europe demonstrates moderate but steady growth patterns, with forecasts projecting a compound annual growth rate of approximately 5.7 percent from 2026 through 2034. While this pace trails both North American and Asia-Pacific expansion rates, Europe maintains a mature and stable market characterized by sophisticated consumer preferences and established distribution channels.

Board Game Genre Statistics and Product Segmentation

Market segmentation by game theme and product type reveals consumer preferences that shape development priorities and investment decisions across the industry.

| Game Category | Market Share / Revenue | Key Characteristics |

|---|---|---|

| Strategy and War Games | ~24% | Complex mechanics, longer play sessions |

| Traditional Games (Monopoly-style) | ~$3.0 billion | Family-friendly, mass-market appeal |

| Puzzle and Brain Teasers | Leading segment | Educational value, broad age range |

Strategy Board Games Market Share

Strategy and war-themed board games accounted for approximately 24 percent of total market share by theme classification in 2024. This substantial portion reflects sustained consumer appetite for games offering depth, replayability, and competitive gameplay experiences that reward strategic thinking and tactical planning.

The enduring popularity of strategy games demonstrates that despite the rise of digital entertainment, many players still seek the tactile satisfaction and social interaction that physical board games provide. Just as players enjoy multiplayer gaming experiences, strategy board games create opportunities for face-to-face competition and collaboration.

Traditional and Classic Board Game Revenue

The Monopoly and classic board game product category generated approximately $3 billion in revenue during 2024. This substantial figure underscores the continued commercial viability of established intellectual properties and familiar game mechanics that appeal across multiple generations.

Traditional games benefit from strong brand recognition, straightforward rules that facilitate quick onboarding, and nostalgic associations that drive purchasing decisions among parents introducing games to their children.

Puzzle Games in the Board Game Market

Puzzle games, including jigsaws and brain teasers, historically generated $6.9 billion in revenue during the early 2020s, establishing puzzles as a dominant segment within the broader tabletop entertainment category. While more recent genre-specific revenue data remains limited, puzzles maintain strong baseline adoption rates due to their accessibility, educational benefits, and suitability for solo or group play.

Board Game Market Forecast Through 2033

Long-term projections for the U.S. board game market illustrate the sustained growth trajectory expected throughout the remainder of the current decade and into the early 2030s.

| Year | U.S. Market Value | Growth Rate (CAGR) |

|---|---|---|

| 2024 | $4.58 billion | Baseline year |

| 2033 (Projected) | $11.73 billion | 9.87% |

The projected near-tripling of the U.S. market from $4.58 billion to $11.73 billion represents remarkable expansion for a mature product category. This growth suggests that board games are successfully attracting new demographics, retaining existing enthusiasts, and benefiting from adjacent trends such as the cafe board game venue phenomenon and increased interest in unplugged entertainment options.

Production Challenges and Supply Chain Factors in 2026

While market projections paint an optimistic picture, the board game industry faces significant operational headwinds that could influence pricing, availability, and profitability throughout 2026 and beyond.

Tariff Impact on Board Game Manufacturing

A 54 percent tariff on Chinese imports, which took effect on April 5, 2026, has created what industry publishers describe as seismic shifts in production cost structures. Given that the majority of board game components are manufactured in China, these tariffs directly impact retail pricing and publisher margins.

The cost inflation has already affected major releases, with publishers like Cephalofair Games placing anticipated titles such as Gloomhaven Second Edition on indefinite hold due to prohibitive production expenses. These delays signal that the tariff situation may constrain the pace of new product introductions and force smaller publishers to reconsider ambitious projects.

Crowdfunding Platform Consolidation

The 2026 merger between Gamefound and Indiegogo represents a significant consolidation within the crowdfunding infrastructure that many board game creators rely on for project financing. This merger concentrates market power among fewer platforms, potentially affecting creator terms, backer experiences, and the overall dynamics of how new games reach market.

Crowdfunding has become an essential channel for independent board game developers, and platform changes could reshape which projects secure funding and how established publishers utilize these tools for market testing and community engagement.

Tabletop Gaming Industry Revenue Statistics

Supplementary revenue data provides additional context for understanding market scale across different categorization approaches.

Global board game revenue was reported at $8.3 billion in 2023, with projections indicating growth to $9.0 billion by 2026. These figures likely represent a narrower definition focused specifically on board game revenue streams while excluding related categories such as playing cards, miniatures, or accessories.

The broader playing cards and board games global market measured $20.31 billion in 2024, offering a more comprehensive lens that captures adjacent tabletop revenue sources. These varying metrics help triangulate where pure board game revenue sits within the larger tabletop games and hobby entertainment ecosystem.

Much like how free online gaming platforms have carved out distinct market segments, traditional board games continue to maintain their unique position within the broader entertainment landscape.

Consumer Trends Driving Board Game Market Growth

Several underlying consumer behavior patterns contribute to the sustained expansion of the board game market despite competition from digital entertainment alternatives.

Social Play and Community Building

Board games provide inherently social experiences that facilitate face-to-face interaction, making them particularly appealing in an increasingly digital world. Game nights, board game cafes, and organized play events create community touchpoints that strengthen player engagement and drive repeat purchases.

The social dimension aligns with broader entertainment trends toward experiential consumption and shared activities that create memorable moments. Players value the communal aspects of gathering around a table, learning rules together, and experiencing the unpredictable dynamics that emerge through group play.

Collector Demand and Premium Products

A growing collector segment seeks premium editions, expansions, limited releases, and Kickstarter exclusives that enhance both gameplay and display appeal. This enthusiast market supports higher price points and drives engagement with crowdfunding campaigns that offer exclusive content unavailable through retail channels.

Collector behavior creates sustained demand beyond initial purchases, as dedicated fans pursue complete collections, upgraded components, or special editions that elevate their gaming experience.

Hybrid Digital Integration

Many modern board games now incorporate companion apps, digital tutorials, or online play options that blend physical and digital elements. This hybrid approach addresses player preferences for convenience features like automated scorekeeping, rules clarification, or asynchronous online play while maintaining the tactile satisfaction of physical components.

Digital integration also facilitates broader market reach by enabling remote play between geographically separated players, expanding the potential audience beyond those able to gather in person. Similar to crossplay functionality in video games, these features reduce barriers to participation.

Board Game Distribution Channels and Retail Trends

Distribution patterns have evolved significantly, with multiple channels serving different consumer segments and purchase behaviors.

Specialty Retail and Game Stores

Dedicated hobby shops and game stores remain crucial distribution points, particularly for complex strategy games, collectible releases, and products targeting enthusiast audiences. These retailers provide knowledgeable staff, demo opportunities, and community spaces that support the hobby’s social dimensions.

Mass Market Retail and Online Platforms

Major retailers and e-commerce platforms dominate sales of mainstream family games and licensed properties. Online marketplaces offer convenience, competitive pricing, and extensive selection, though they lack the curated expertise and community aspects of specialty retailers.

The balance between channels continues shifting as consumer preferences evolve and distribution costs influence publisher strategies.

Innovation and Design Trends in Modern Board Games

Contemporary board game design reflects sophisticated mechanics and thematic diversity that distinguish modern releases from earlier generations of products.

Narrative-Driven Campaign Games

Story-focused designs that unfold across multiple sessions have gained popularity, offering progression systems, branching narratives, and persistent consequences that create memorable campaign experiences. These games blur the line between board games and role-playing games, attracting audiences interested in immersive storytelling.

Asymmetric Player Powers and Variable Setup

Modern designs frequently feature unique player abilities, variable starting positions, or modular boards that ensure each play session differs substantially. This replayability factor increases perceived value and encourages repeated play as participants explore different strategies and combinations.

Accessibility and Inclusive Design

Growing attention to accessibility considerations has led to improved component design, clearer iconography, colorblind-friendly palettes, and simplified rulebooks. These improvements broaden potential audiences and remove barriers that previously excluded some players from participation.

Competitive Landscape and Major Publishers

The board game industry encompasses both large established publishers and numerous independent creators, creating a diverse competitive environment.

Major publishers leverage established distribution networks, recognizable licenses, and marketing resources to maintain market leadership in mass-market segments. Meanwhile, independent designers and smaller publishers frequently drive innovation through crowdfunding platforms, introducing fresh mechanics and themes that larger companies may later adopt or acquire.

This competitive dynamic fosters creativity while ensuring established properties continue receiving new editions and expansions that serve existing fan bases.

Key Takeaways from Board Game Statistics 2026

The comprehensive board game statistics paint a picture of an industry experiencing sustained growth across multiple dimensions.

Market expansion demonstrates strong momentum across all major forecasting models, with compound annual growth rates consistently exceeding 8 percent through the next decade. Multiple research sources confirm these trajectories despite minor variations in specific valuations based on segmentation methodologies.

Regional dynamics show North America maintaining its 41.7 percent market share in 2024, while Asia-Pacific emerges as the fastest-growing region with approximately 6 percent CAGR projected through 2034. The U.S. market specifically is forecast to expand from $4.58 billion in 2024 to $11.73 billion by 2033, representing nearly threefold growth at a 9.87 percent CAGR.

Genre statistics reveal that strategy and war-themed games held approximately 24 percent market share in 2024, while traditional titles in the Monopoly category generated roughly $3 billion in revenue. Puzzle games maintain strong baseline adoption with historical revenues around $6.9 billion in the early 2020s.

Production challenges present notable headwinds, particularly the 54 percent tariff on Chinese imports implemented in April 2026, which has caused significant cost inflation and project delays. Crowdfunding platform consolidation through the Gamefound and Indiegogo merger may also reshape how independent creators access capital and market their products.

Consumer trends favor social play experiences, premium collector products, and hybrid digital integration that combines physical components with companion apps or online functionality. These preferences align with broader entertainment consumption patterns while preserving the distinctive qualities that differentiate board games from purely digital alternatives.

FAQs

What is the current global board game market size?

▼

What is the projected growth rate for board games through 2033?

▼

Which region has the largest board game market share?

▼

What board game genres are most popular in 2026?

▼

How are tariffs affecting board game production in 2026?

▼

Which region shows the fastest board game market growth?

▼

What is the U.S. board game market forecast for 2033?

▼

How much will the tabletop games segment grow by 2029?

▼

References and Citations

- IMARC Group – Global Board Games Market Report 2024-2033. Available at: https://www.imarcgroup.com/board-games-market

- Fortune Business Insights – Board Games Market Size, Share & Growth Analysis 2024-2032. Available at: https://www.fortunebusinessinsights.com/board-games-market-106916

- Grand View Research – Playing Cards & Board Games Market Analysis 2026-2030. Available at: https://www.grandviewresearch.com/industry-analysis/playing-cards-board-games-market

- The Verge – Board Game Publishers Struggle With New Chinese Import Tariffs. Available at: https://www.theverge.com/2025/4/10/board-game-tariffs-china

/wp:html

wp:paragraph

/wp:paragraph