In-Game Purchase Spending Habits in 2026

wp:html

html

The rise of mobile platforms has accelerated this trend significantly. Players now spend billions annually on virtual items, battle passes, and premium currency across devices. Understanding these patterns helps reveal not just where money flows, but how gaming monetization strategies shape player experiences across different markets and demographics.

Global Market Revenue from In-Game Purchases

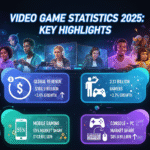

The global gaming market continues its impressive expansion in 2026. Total revenue projections indicate the industry will reach approximately 188.8 billion dollars this year, representing steady growth from previous periods. Within this massive market, in-game purchases constitute a substantial portion of overall earnings.

Mobile gaming dominates the revenue distribution, accounting for roughly 55 percent of the total market share. This translates to approximately 103 billion dollars generated from mobile platforms alone. The prominence of mobile reflects broader accessibility patterns, as smartphones have become the primary gaming device for millions of players worldwide.

Platform Distribution of Gaming Market Revenue 2026

Specific data on in-game purchase markets shows that the IGP segment will generate approximately 74.4 billion dollars in 2026. Mobile in-app purchases alone accounted for 82 billion dollars in 2024, demonstrating a 4 percent year-over-year increase. These figures underscore how central microtransactions have become to the business model of contemporary gaming, particularly within the Gaming as a Service framework that many developers now adopt.

In the United States specifically, total video game spending reached 58.7 billion dollars in 2024. Of this amount, approximately 50.6 billion dollars represented spending on game content, whether digital downloads, physical media, or in-game purchases. This substantial content spending illustrates the American market’s appetite for ongoing game investments beyond initial purchases.

Regional Growth Patterns in Mobile In-App Purchase Spending

Examining regional variations reveals distinct patterns in how in-game purchase spending habits evolve across different markets. While global mobile IAP grew by 4 percent in 2024, individual regions experienced vastly different trajectories that reflect local economic conditions and gaming culture.

Regional Mobile IAP Growth Rates 2024

North America demonstrated solid growth with a 9 percent increase in mobile IAP spending during 2024. This growth suggests that Western markets continue to expand their spending despite already high baseline levels. The increase reflects both growing player engagement and successful monetization strategies from developers operating in these regions.

Europe outpaced North America with an impressive 14 percent year-over-year growth in mobile in-app purchases. This acceleration indicates increasing player willingness to spend on mobile games across European markets. Factors driving this growth likely include improved game quality, more sophisticated monetization that respects player preferences, and broader smartphone adoption across age demographics.

Latin America and the Middle East posted even stronger gains, with 13 percent and 18 percent growth respectively. These emerging markets represent frontiers for gaming expansion, where rising internet penetration combines with growing disposable income to create favorable conditions for mobile gaming monetization. The high growth rates suggest these regions will become increasingly important to global gaming revenue in coming years.

Asia experienced a 3 percent decline in mobile IAP spending when measured in US dollar terms. However, this decrease primarily reflects currency fluctuations rather than actual reductions in local spending. When evaluated in local currencies, Asian markets likely maintained stable or even positive growth, emphasizing the importance of considering exchange rates when analyzing international gaming revenue trends.

Player Spending Behavior and Demographics

While aggregate revenue numbers tell one story, understanding who actually spends money provides crucial context for in-game purchase spending habits. Research from European markets offers valuable insights into the concentration of paying users within gaming populations.

Data from 2024 indicates that only 11 percent of European players aged 11 to 64 made any real money purchases in games during the year. This relatively small fraction of paying customers means that the vast majority of players engage with games without ever spending money, relying instead on free-to-play options or content included with their initial purchase.

Among European players who did spend money, the average expenditure was 31 euros in 2024, representing a significant 21 percent decrease from the 39 euro average in 2023. This reduction suggests shifting player priorities or increased price sensitivity among gaming audiences.

The decline in average spending per paying user presents an interesting paradox. Even as total market revenues grow, individual spenders may be reducing their outlays. Several factors could explain this pattern, including greater competition among games for player attention and spending, economic pressures affecting discretionary income, or shifts in monetization strategies that emphasize broader participation at lower price points rather than extracting maximum value from dedicated spenders.

These demographic patterns reveal that gaming monetization relies heavily on converting a small percentage of players into paying customers. The industry term for high-spending players is often whales, referring to users who contribute disproportionately large amounts relative to the average. While precise global statistics on whale behavior remain limited, industry analysis consistently shows that a tiny fraction of users generates the majority of in-game purchase revenue.

This concentration creates interesting dynamics around game design and monetization ethics. Developers must balance monetization pressure with player satisfaction, particularly when most revenue comes from a small subset of users who may be more vulnerable to spending beyond their means. These considerations become particularly relevant when examining markets like mobile gaming trends where monetization mechanisms are most sophisticated.

Case Study: High-Revenue Mobile Game Performance

Examining individual game performance provides concrete examples of how in-game purchase spending habits translate into massive revenue streams. The mobile title Last War: Survival offers a particularly instructive case study in rapid monetization success.

Last War: Survival Monthly Revenue Growth 2024

In January 2024, Last War: Survival generated approximately 30 million dollars in monthly revenue. By December of the same year, monthly earnings had skyrocketed to 138 million dollars. This represents an extraordinary 360 percent growth rate over the course of just twelve months, demonstrating how quickly successful mobile games can scale their monetization.

The game’s lifetime revenue trajectory proved equally impressive. By September 2024, Last War: Survival had accumulated 1 billion dollars in total revenue since launch, a milestone achieved in less than one year. Just five months later in February 2026, lifetime revenue doubled to 2 billion dollars, illustrating sustained momentum in player spending.

This exceptional performance highlights several important aspects of modern gaming monetization. First, hit titles can generate enormous returns in relatively short timeframes, particularly on mobile platforms where user acquisition and monetization mechanics are highly optimized. Second, successful games often exhibit exponential rather than linear growth patterns, as word-of-mouth and marketing investments compound over time.

The Last War case also demonstrates how revenue concentration affects the broader market. While thousands of games compete for player attention and spending, a small number of breakout hits capture disproportionate shares of total revenue. This winner-take-most dynamic shapes developer strategies and investment decisions across the industry, similar to patterns observed in other digital distribution markets.

Monetization Strategies and Psychological Triggers

Understanding how games encourage spending requires examining the psychological and design mechanisms that influence player behavior. Recent research into mobile game monetization reveals sophisticated approaches that go far beyond simple item sales.

A 2026 study analyzing Korean mobile games identified several key monetization strategies employed by successful titles. Time gates represent one common approach, limiting how much content players can access within specific periods. This creates natural pressure points where players may choose to spend money to bypass waiting periods or access additional content immediately.

Social conflict mechanics also drive spending by creating competitive or cooperative scenarios where purchases provide advantages. Whether competing against other players or working together toward shared goals, social dynamics amplify the perceived value of in-game purchases. Players may spend money not just for personal progression but to maintain status within their gaming communities or contribute to team success.

Scarcity design techniques create urgency around purchasing decisions. Limited-time offers, exclusive items available only during specific events, and rotating shop inventories all leverage loss aversion psychology. Players fear missing out on opportunities, which can prompt purchases they might otherwise skip. This approach mirrors tactics used in the broader downloadable content market where timed exclusives drive sales.

Research on peer effects in gaming adoption suggests that social influence extends to spending behavior as well. Players are more likely to make purchases when friends do, particularly close friends rather than casual acquaintances or high-profile players. This social reinforcement creates cascading effects where initial spenders can indirectly encourage additional purchases within their social networks.

These behavioral insights explain why in-game purchases persist despite criticism from some gaming communities. Well-designed monetization systems align with natural player motivations and social dynamics rather than feeling like crude cash grabs. The most successful implementations integrate purchases seamlessly into gameplay loops, making spending feel like a natural extension of the gaming experience rather than an interruption.

Extreme Spending Patterns and Consumer Protection Concerns

While most players spend modestly or not at all, certain demographics exhibit concerning patterns of excessive expenditure on microtransactions. A 2026 consumer finance survey from Japan provides troubling insights into how in-game purchase spending habits can become problematic.

The survey found that approximately 18.8 percent of Japanese respondents aged 20 to 29 admitted spending so heavily on microtransactions that it impaired their ability to pay essential living expenses like rent. Nearly one in five young adults in this demographic reported that gaming expenditures created financial hardship, suggesting that addiction-like spending behaviors affect a significant minority.

Problematic Microtransaction Spending by Gender (Japan, Ages 20-29)

Gender differences emerged in the survey data, with men reporting higher rates of problematic spending at 22.8 percent compared to 14.8 percent among women. These disparities might reflect different gaming preferences, with men more likely to engage with competitive titles or genres that employ aggressive monetization strategies.

While Japan’s results may not generalize perfectly to other markets due to cultural and economic differences, they highlight genuine risks associated with modern gaming monetization. The combination of psychological triggers, social pressure, and easily accessible payment methods can create conditions where vulnerable individuals spend beyond their means.

These patterns raise important questions about industry responsibility and regulatory oversight. Unlike traditional gambling, in-game purchases often operate in legal grey areas with minimal consumer protection requirements. Some jurisdictions have begun implementing regulations around loot boxes and other randomized purchase mechanics, but comprehensive frameworks remain limited.

The gaming industry faces growing pressure to implement safeguards that protect vulnerable players while preserving legitimate monetization. Potential interventions include spending limits, cooling-off periods before large purchases, transparent disclosure of odds for randomized rewards, and tools that help players track their cumulative spending over time. These considerations become particularly important when examining free-to-play platforms where monetization mechanisms are most prevalent.

Emerging Trends in In-Game Purchase Spending Habits for 2026

Several important shifts are reshaping how players spend money on games and how developers approach monetization. These trends will likely define the industry landscape for the coming years.

Shift Toward Broader But Smaller Spending

The decline in average spending per paying user in European markets from 39 euros to 31 euros represents more than temporary fluctuation. This pattern suggests a strategic pivot by developers toward monetization models that emphasize converting more players to paying status at lower individual price points rather than maximizing extraction from dedicated whales.

This approach offers several advantages. Broader monetization reduces reliance on small numbers of high spenders, creating more stable and predictable revenue streams. It also helps address ethical concerns about exploitative monetization by distributing spending more evenly across player populations. Games that successfully implement this model may gain competitive advantages through improved player sentiment and reduced regulatory risk.

Geographic Revenue Diversification

The 3 percent decline in Asian mobile IAP revenue measured in US dollars contrasts sharply with double-digit growth in Latin America, the Middle East, and Europe. This geographic shift reflects both currency effects and fundamental changes in where gaming growth occurs.

Emerging markets offer enormous untapped potential as internet infrastructure improves and smartphone adoption expands. Developers increasingly design games with global audiences in mind, adapting monetization and content to suit local preferences and economic conditions. The most successful titles will balance universal appeal with regional customization, similar to strategies employed across console gaming markets.

Revenue Concentration Among Hit Titles

The extraordinary success of games like Last War: Survival demonstrates how revenue increasingly concentrates among a small number of breakout hits. This winner-take-most dynamic creates challenging conditions for smaller developers and new entrants who struggle to compete for player attention and spending.

Market concentration may accelerate as successful publishers reinvest profits into user acquisition, live operations, and content updates that maintain player engagement. The gap between hits and also-rans could widen, potentially reducing overall industry diversity and innovation as resources flow toward proven formulas rather than experimental designs.

Sophisticated Monetization Design

Research into psychological triggers and social dynamics reveals that monetization strategies are becoming more nuanced and less intrusive. Rather than constantly pestering players with purchase prompts, successful games integrate spending opportunities naturally into gameplay progression.

This sophistication extends to personalization, with games increasingly using data analytics to tailor offers and pricing to individual player preferences and spending capacity. While this raises privacy concerns, it also enables more efficient monetization that better matches player willingness to pay with available options.

Growing Attention to Consumer Welfare

Cases of extreme spending behavior, particularly the Japanese survey data showing nearly one in five young adults experiencing financial hardship due to microtransactions, are driving increased scrutiny of gaming monetization practices.

Regulatory attention will likely intensify, particularly around mechanics that resemble gambling such as loot boxes and gacha systems. Industry self-regulation may accelerate as companies seek to avoid more restrictive government interventions. Expect to see more spending limits, enhanced disclosure, and tools that promote responsible spending behavior.

FAQs

What percentage of gamers actually spend money on in-game purchases?

Research from European markets shows approximately 11 percent of players make any real money purchases in games. The vast majority play without spending, while a small fraction generates most revenue through microtransactions and in-app purchases.

How much do paying players typically spend on in-game purchases?

Among European players who spent money in 2024, the average was 31 euros, down from 39 euros in 2023. Spending varies significantly by region, game genre, and individual player behavior patterns.

Which gaming platform generates the most in-game purchase revenue?

Mobile platforms dominate in-game purchase revenue, accounting for approximately 55 percent of the global gaming market. Mobile generated over 82 billion dollars in in-app purchases during 2024, significantly outpacing console and PC combined.

What regions show the fastest growth in gaming spending?

The Middle East led growth with 18 percent year-over-year increase in mobile IAP spending, followed by Europe at 14 percent and Latin America at 13 percent. Emerging markets demonstrate strongest growth trajectories currently.

Can in-game purchases become financially harmful?

Yes, certain demographics show concerning patterns. A Japanese survey found 18.8 percent of respondents aged 20 to 29 spent so heavily on microtransactions that it impaired their ability to pay essential living expenses like rent.

References

- Newzoo. (2026). Global Games Market Report. https://newzoo.com

- Sensor Tower. (2024). Mobile App Revenue Report. https://sensortower.com

- Video Games Europe. (2024). European Gaming Consumer Behavior Study. https://www.videogameseurope.eu

- Polygon. (2026). Japan Gaming Finance Survey Coverage. https://www.polygon.com

/wp:html